Your Partners in Smart Storage Solutions

Leading provider of industrial automation, file digitization, and commercial storage solutions for every industry. Level up your workplace with our modern systems!

Public Safety

Enhance your department with secure Gear lockers, evidence storage, pass-thru lockers, weapons storage, and high-density mobile systems.

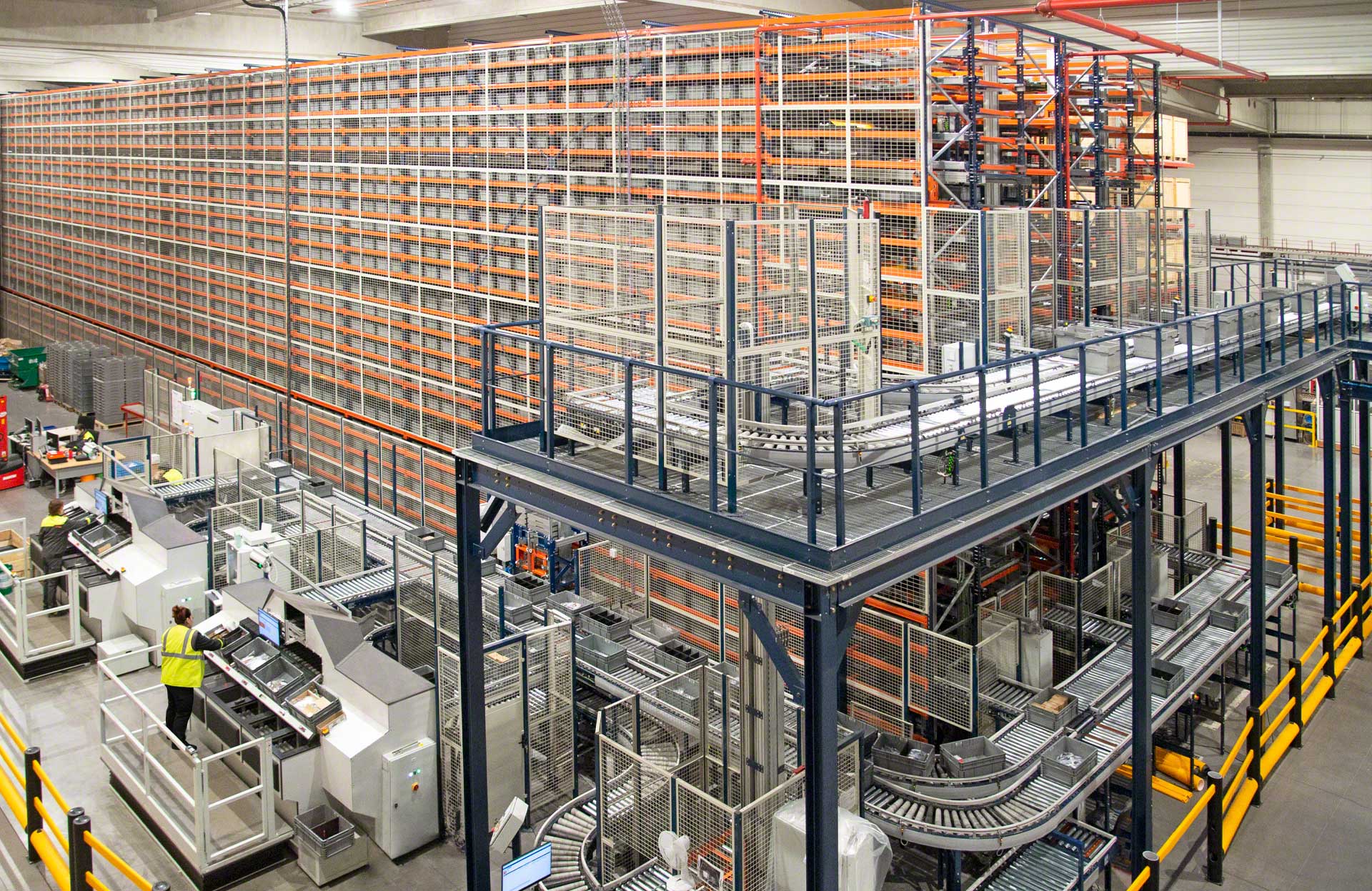

Industrial

Upgrade your facility with Vertical lift modules (VLM), ergonomics & safety equipment, ASRS, automation, warehouse racking, and bulk storage.

Business

Upgrade your workplace with High-density file storage, smart lockers, day-use lockers, mail centers, modern shelving systems, and modular casework.

Athletics

Store sports equipment, uniforms, gear, apparel, and more with a high-density mobile storage system & locker room configured for a winning season!

Healthcare

Make the Most of your available space with Bedlifts, storage bins, materials management, cold storage, high-density storage, and modular casework.

Document Scanning & Digitization

Bring your business to the cloud with secure Document imaging, information management, compliance, digital transformations, and file preservation.

Storage Solution Applications

Industrial Storage Solutions

Industrial warehouses can be a challenge when considering storage options. Many facilities are in need of accommodating...

Modula Vertical Lift Modules

Vertical storage solutions are the best way to make use of every inch of warehouse space you have...

Warehouse Racking

Discover the pinnacle of storage efficiency with our Selective, Structural, Drive-In, and other industrial racking solutions...

Vidir Vertical Lifts

Vertical lifts aren’t just for parts manufacturers and warehouses. These cost-effective storage systems are ready to handle any part or material.

Wire Cages & Fencing

Elevate your facility’s safety & organization with a comprehensive range of Wire Fence Storage options. From Machine Guarding to Pallet Fencing...

Industrial Mezzanines

Transform your workspace with our Free-Standing, Shelving-Supported, and Rack-Supported Mezzanines. Our durable, versatile free-standing mezzanines...

Modular Offices, Walls & Buildings

Elevate your workspace with our Modular Offices and Buildings, offering rapid, cost-effective solutions for expanding...

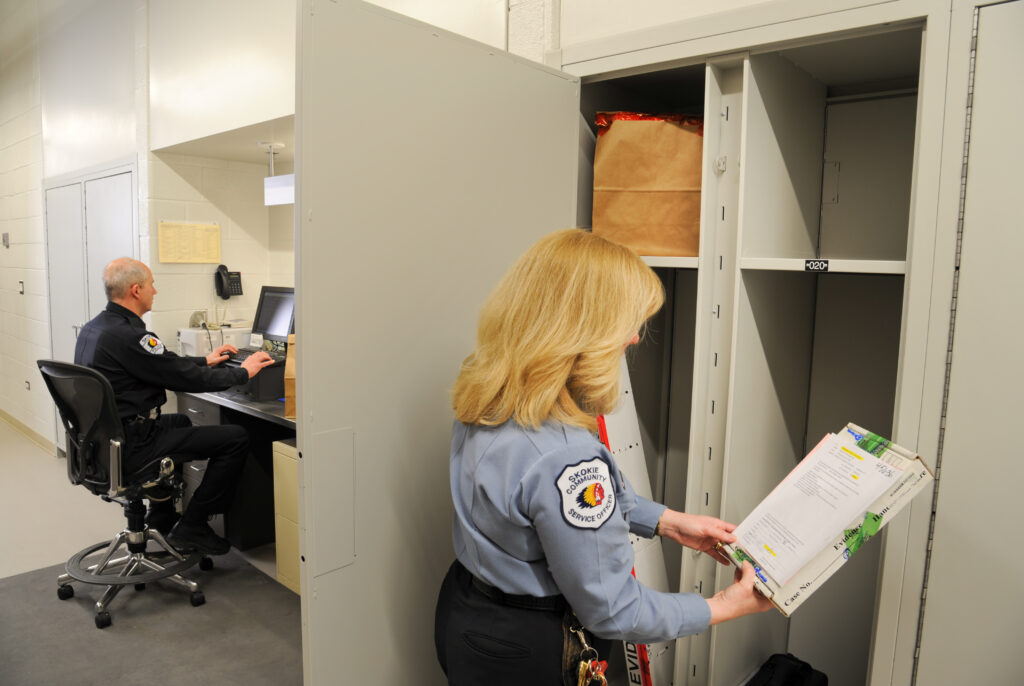

Public Safety Overview

Law enforcement agencies, courthouses, crime labs, corrections facilities, and more focus on distinctly different aspects of public safety...

Public Safety Lockers

Police departments know that their most valuable assets are their people. Public safety spaces need secure equipment and gear lockers...

Evidence & Records Storage

Losing or misplacing a piece of evidence isn’t just a department’s problem. Lost evidence in storage can quickly become a PR crisis...

Weapons & Ammunition Storage

In collaboration with Spacesaver, we’ve created a variety of weapons storage systems that create visibility...

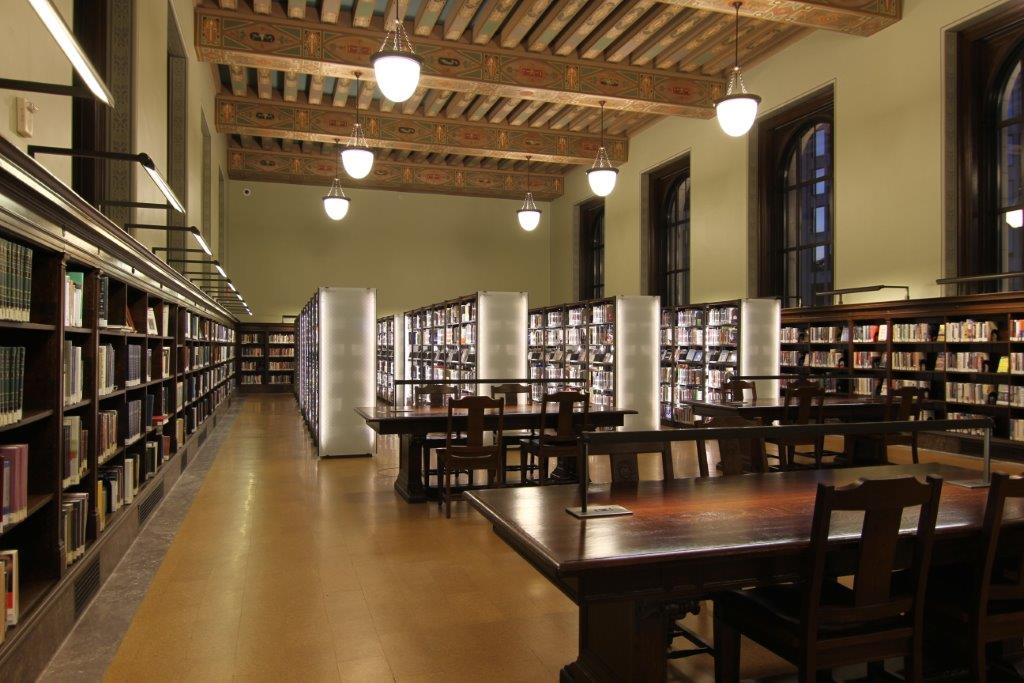

Education Overview

By offering smart storage in your high school or university library, students & visitors have the option of accessing a secure personal locker whenever they...

School Library Storage

As campus libraries change to meet the needs of their communities, staff need to create space for new uses while still accommodating book collections...

Campus Mailroom Systems

Students count on a reliable flow of personal communication, your mail center should not only be the hub of this information...

Collections & Archives

One element of serving students is preserving and protecting special collections, records, and archive materials...

Library Storage Solutions

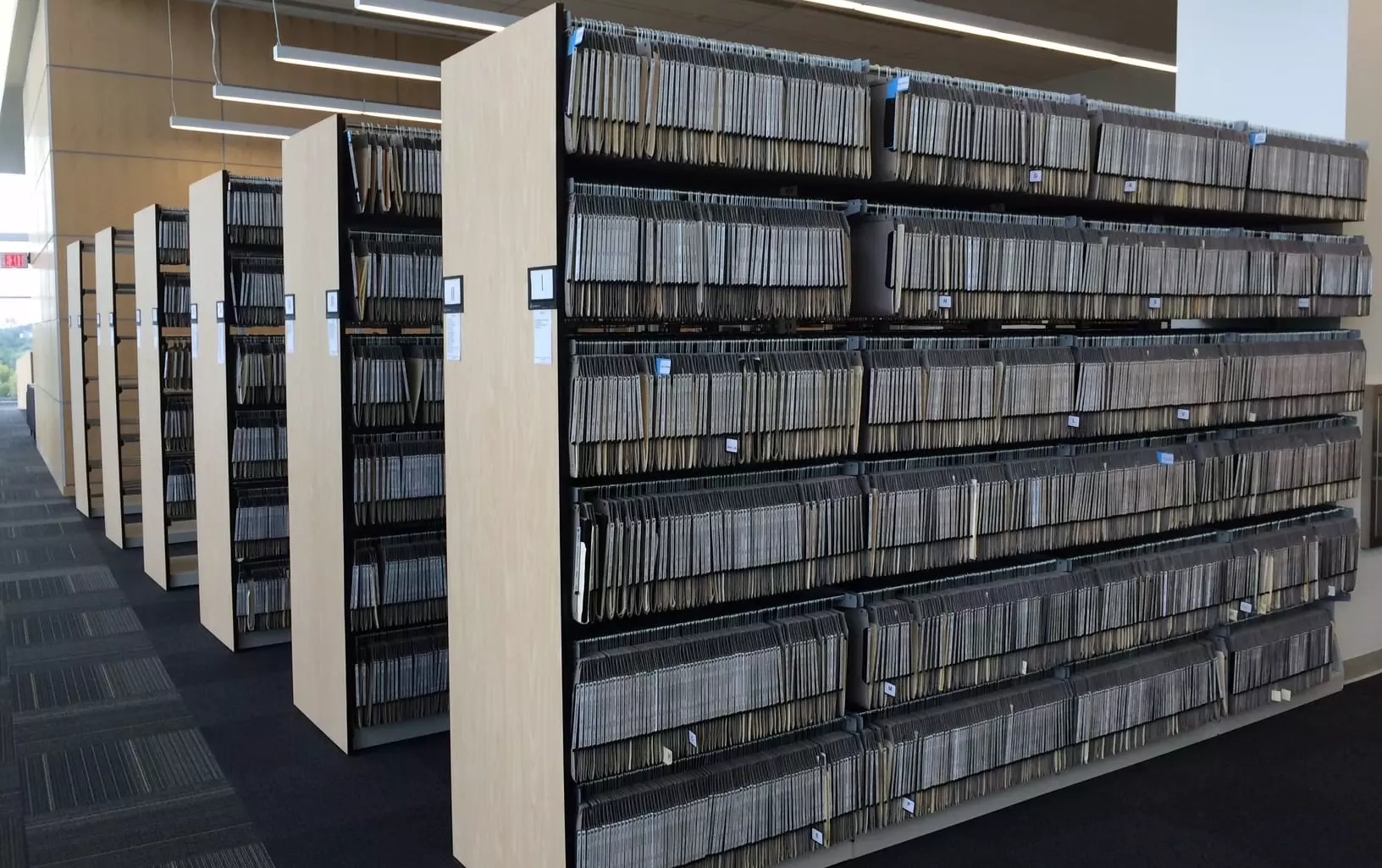

Today’s library storage is evolving. It’s shifting from a place to simply check out a book or study to being a pillar of their communities...

Cantilever Library Shelving

Also known as the standard in library shelving, cantilever shelving was designed specifically for all libraries and offers a broad range of options....

Public Access Mobile Storage

More than 40 years ago, Bradford Systems partnered with Spacesaver to provide their industry-leading high-density mobile shelving...

Children’s Library Spaces

On average, children and young adults constitute 60% of a library’s patronage – yet many libraries are lacking in children’s library spaces...

Museum Storage

Historical artifacts come in all shapes and sizes from dinosaurs to daisies. Our lineup of fully customizable museum cabinets protect collections, save space...

Collection-Specific Cabinetry

From intricate artifacts on display to behind-the-scenes laboratory materials, we can assist your museum in the selection of the proper system...

Art Rack Storage

There’s the issue of keeping a collection secure and there’s also additional considerations, such as humidity and temperature control, fire protection...

Archival Document Management

Archive storage must be protective, easy to navigate, and space-efficient. Items must be able to be located and retrieved quickly when needed...

Athletic Storage

Your athletic equipment storage is so much more than just a glorified storage closet – it’s the place where victory...

Football Locker Rooms

Football teams must keep equipment, gear, and uniforms organized. These need to be quickly accessible...

Hockey Gear Storage

Hockey players need their gear neatly sorted and easy to grab when it's time ot hit the ice. Find out how...

Baseball Equipment

Help your team stay focused on what matters most - winning the game. Organize baseball bats, gloves...

Corporate Storage Solutions

The leading supplier of corporate storage solutions: shelving, employee lockers and more...

Employee Lockers

Bradford Systems can create a modern locker storage system for any commercial space. Our lockers are available...

File Storage

We offer an array of file storage options to ensure that your files are organized, retrievable, and secure no matter...

Modular Mailrooms

Mail center systems offer a flexible, efficient space for package sorting, mail distribution, copy, fax, and more...

Office Supply Shelving

Supply storage for corporate businesses is an evolving cycle. Staying competitive with new trends for the right kind....

Agile Pantry & Breakroom

Creating a breakroom space that is dedicated to inviting conversation, it can become a social hub of the office...

Military Storage Solutions

With over one million active personnel across all defense forces of the United States military, one thing is for certain...

Secure Gear Lockers

Keeping military personnel gear and equipment ready at a moments notice is critical for successful operations...

Weapons Storage

Armed forces, including the national guard, coast guard, and other branches of the military, require reliable...

Supplies & Deployment Storage

Proper storage is not just about placing parachutes in a designated space; it involves a comprehensive approach...

Healthcare Storage

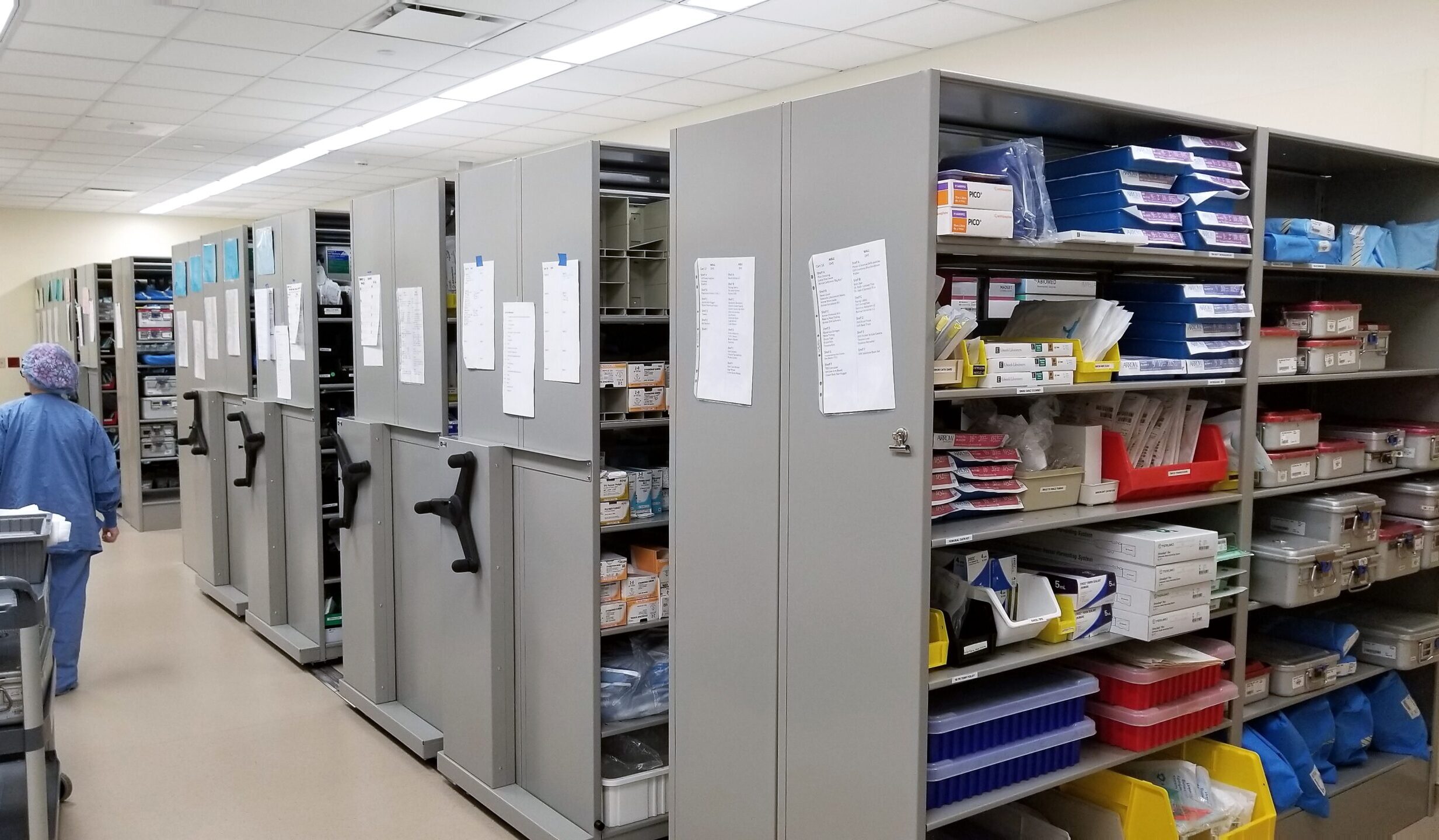

As medications, equipment, supplies, and files continue to grow, it may seem impossible for your facility to keep up...

Pharmacy Solutions

The best pharmacy shelving solutions provide dense storage capacity, easy access, and good visibility...

Materials Management

Practicing proper hospital materials management involves careful planning to ensure supplies are there when needed...

Hospital Bed Lifts

Hospital beds take up unnecessary floor space which drastically reduce available sanitized areas, creating safety...

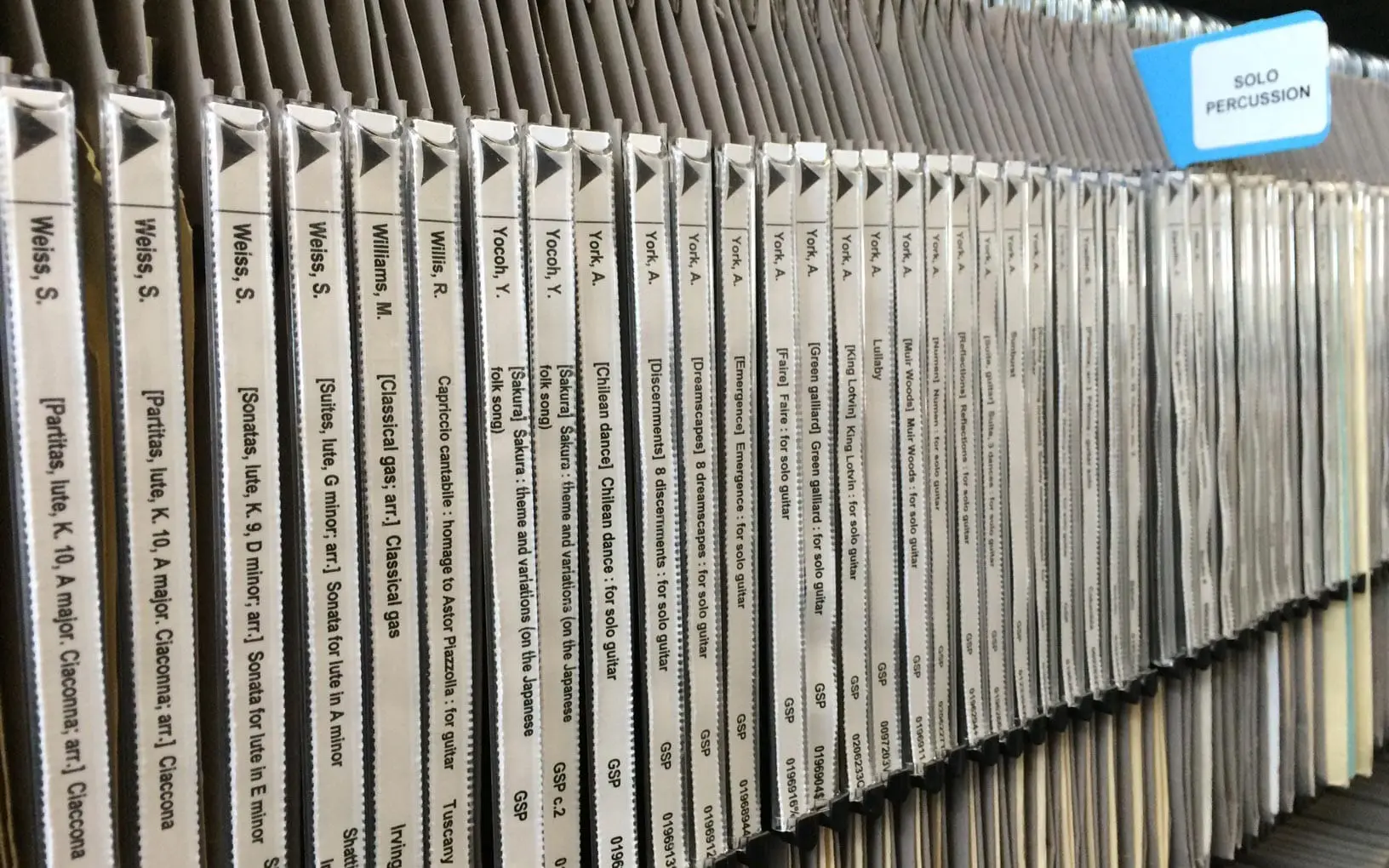

Music Filing

We are the first filing and storage specialist focused on the needs of schools’ music departments. Whether you’re a high school...

Sheet Music Storage

We’ve worked with hundreds of music programs in high schools and universities across the country to help them catalog and organize...

Music Instrument Storage

We’ve worked with hundreds of music programs in high schools and universities across the country to help them store their musical...

Skokie Police Department

Located just 16 miles west of downtown Chicago, the village of Skokie, Illinois, is home to over 65,000 people who enjoy the vibrant feel of city life in a welcoming suburban setting. Known for its tagline, “Skokie: A Suburb That Feels Like a City,” this fast-growing area combines convenience with community appeal.

With Skokie’s rapid growth, the police department’s needs expanded beyond the 27,000 square-foot building that had previously served the department. As Skokie’s demands evolved, so did the requirements for an effective, organized, and secure storage system to support the modern needs of the force.

Notre Dame Football Equipment Room

With 11 consensus National Championships, 97 All-Americans, and 486 Fighting Irish players chosen by NFL teams in the Draft, Notre Dame’s football team is one of the most recognized and iconic programs in college sports history. But when wasted space, crowded conditions, and lack of storage were contributing to an equipment room that wasn’t functional, Notre Dame’s equipment manager turned to Bradford for an analysis of their space and how their gear and equipment could be better stored.

St. Louis Central Library

Built over a hundred years ago and located in the heart of the city’s vibrant downtown, the St. Louis Central Library’s architecture has been a “must-visit” for visitors all over the world. Cass Gilbert, the library’s architect, was famous for Manhattan’s Woolworth Building and Washington DC’s United States Supreme Court Building—and the Italian Renaissance style he favored can be seen in the beautiful library’s elaborate construction.

Chicago’s Field Museum

Chicago’s Field Museum is one of the largest natural history museums in the world. With 24 million specimens in its collection and a growth rate of 200,000 items per year, the museum was struggling with not only having the right kind of storage, but enough storage. When the Museum embarked on a two-level, 180,000 square foot building to protect their collections, they reached out to us to help with storage systems that offered protection and accessibility.

Featured Storage Solutions

Industrial

Today’s industrial warehouses can be a challenge when considering storage options. Many facilities are in need...

Public Safety

Law enforcement agencies, courthouses, crime labs, corrections facilities, and more focus on distinctly...

Education

Education is the foundation to life’s success. For this reason, we take education storage issues very seriously...

Library

Today’s library storage is evolving. It’s shifting from a place to simply check out a book or study to being...

Museums

When you have over 2.2 million objects and specimens in your collection, it doesn’t take much too run out...

Athletic

Your athletic equipment storage is so much more than just a glorified storage closet – it’s the place where...

Workplace

From the number of companies embracing open office concepts, to the rise of co-working and hoteling storage...

Military & Government

We have a strong understanding of military storage needs – in the armory, long-term storage facilities, or in deployment...

Healthcare

Space in healthcare is expensive to design, build, and occupy. We optimize these environments to save space while...

Music Filing

We are the first filing and storage specialist focused on the needs of archiving music departments. Whether...

Mobile Shelving Creates Space for Notre Dame Football

Increase operational efficiency by creating a movable aisle that can compact storage space, allow access to more goods...

Chicago Museum Uses Compact Shelves

Create extra space for the things that have a direct impact on your organization, regardless of your industry...

Low-Profile High-Density Mobile Shelving

Easy to reconfigure, expand, and relocate, low-profile moving shelving systems combine strength and adaptability...

Mobile Pallet Racking with ActivRAC® Mobilized Storage

Heavy-duty mobile racking is ideal for manufacturing facilities, warehouses, cold storage facilities, and any location...

Cold Storage Mobile Racking with Control Technology

Anchoring our systems to existing concrete makes them a cost-effective solution for increasing capacity in any space...

High-Density Heavy-Duty Racking Solutions

These carriages have a load capacity of 3,000 to 30,000 lbs and are fitted with a host of safety and security features...

XTend High-Bay Archival Shelving

XTend High-Bay Archival Shelving, designed by Spacesaver, is a mobile or static shelving system for off-site archival storage...

Industry-Leading High-Bay Shelving

From storing evidence to archival storage, space-starved organizations are facing growing pressure to find new ways...

Protecting & Preserving to the Highest Extent

Reclaim and optimize your facility. These systems efficiently utilize vertical space, leaving your floor area uncluttered...

4-Post and Case-Type Shelving

An attractive and versatile storage option, our 4-Post and Case-Type shelves are universally slotted—meaning that options like adaptable shelves...

RaptorRAC® Wide-Span Shelving

Spacesaver's rugged and versatile RaptorRAC® Widespan shelving is the perfect solution when standard 4-Post shelving isn't enough to meet your...

XTend® Mobile High-Bay Storage

Static High-Bay Shelving Systems maximize vertical space to more effectively store items such as book trays, archival boxes, and so much more...

Cantilever Library Shelving

From general storage needs, books, and other library materials, cantilever shelving systems provides durable and dependable material storage...

Wire Rack Shelving

Wire shelving is a must for any sterile environment, from healthcare facilities to food service storage. Our metal shelving features easy installation....

Evidence & Records Shelving

When the files your department needs are stored correctly and easily accessible, time will no longer be wasted searching for the documents. Our storage...

Museum Artifact Preservation

When you have over 2.2 million objects and specimens in your collection, it doesn’t take much too run out of storage space—even if you have a large building...

Medical Supply Management

Practicing proper hospital materials management involves careful planning to ensure supplies are there when needed, yet costs are minimized by avoiding...

Warehouse Shelving

This system combines the static XTend High-Bay shelving with mobile carriages—maximizing every inch of your available space by eliminating static...

Athletic Gear Storage

Practicing proper hospital materials management involves careful planning to ensure supplies are there when needed, yet costs are minimized by avoiding...

Lockers Overview

Full locker systems are available for every setting—corporate, healthcare, education, government, public safety, logistics, and more. From day-use...

Locker Applications

We offer many different employee locker types that are perfect for workplace lounges, locker rooms, labs, refrigerated areas, or any space...

Locker Design & Specs

All lockers can be customized to match your space’s aesthetic. You can choose a material and finish that either blends in, or accents your space...

Locker Technology

Eliminating the problems of jammed locks, members losing their keys or coins, or leaving their gym kit locked up for days, these electronic locking...

Public Safety Lockers

Maintaining security means everything when it comes to Public Safety. Choose from personnel lockers, gear lockers, evidence lockers and...

Workplace Lockers

Modern office places are more open need to accommodate employees on the move. These lockers offer flexible storage in a sleek...

Athletic Lockers

In the fast-paced world of athletics, keeping track of every uniform, ball, sock, and piece of gear organized & readily available..

Military Lockers

As personnel numbers continue to grow, the gear, supplies, and weapons that are required to be on hand multiply as well. In partnership with...

Secure Lock Styles

Our innovative locking systems are valued across many industries. We carry the best traditional & digital locks on the market. Choose from smart locks...

Smart Locker Systems

At Bradford Systems, we want to find the smart lockers system that best suits your needs and budget. Perfect for saving time, empowering recipients...

Locker Management Software

Innovative ways to manage your lockers with smart locks paired with networked lockers. To streamline operations, the locking system can be integrated...

Unparalleled Customization

The possibilities are endless! We offer a diverse range of locker sizes, in height, with varying depths and widths to accommodate your spatial requirements...

Flexible Configurations

No matter the dimensions of your space, we specialize in optimizing locker storage solutions tailored to your needs. Whether you need compact lockers for...

Locker Finishes

Available in an array of colors, you can match your locker system to your existing decor or branding. With customizable finishes including laminate...

Interior Accessories

With customizable interiors, businesses can opt for caddies for small item storage, USB charging ports, coat hooks, and more. The customization is...

Vertical Storage

Vertical storage solutions are the best way to make use of every inch of warehouse space you have. With ASRS products like Vertical Lift Modules from Modula or Vertical Carousels from Vidir...

Vertical Lift Modules (VLM)

Modula produces automated storage systems using the most advanced Vertical Lift Module (VLM) technology in the industry. Their innovative solutions save up to 90% of valuable floor space...

Vertical Lifts & Carousels

Vertical lifts aren’t just for parts manufacturers and warehouses. Vidir’s automated Vertical Solutions provide cost-effective storage systems ready to handle any part or material.

Automated Storage/Retrieval Systems (ASRS)

ASRS are computer-controlled systems used to efficiently manage the storage and retrieval of products in warehouses, distribution centers, and logistics facilities.

Modula LIFT

Available in a wide range of sizes and capacities, the Lift is used by businesses everywhere to modernize operations.

Modula SLIM

Modula Slim is the perfect choice for smaller settings in which floor space is at a premium…

Modula Next

Modula Next is an innovative automated storage and retrieval solution that operates on a goods-to-person principle.

Modula Flexibox

Processing up to 180 bins per hour, Modula Flexibox is the smart solution for fast-moving industries.

VLM Software & Accessories

Choose from a variety of features and add-ons to take further advantage of the capabilities Modula’s VLMs provide.

Picking Enhancements

These customizations include intelligent software integrations, put to light, picking solutions, security checkpoints...

Vidir's Vertical Carousels

Vidir’s innovative storage solutions include vertical carousels and lifts that cover an endless range of applications...

Dual-Tower Sheet Metal VLS

Dual-Tower Sheet Metal Vertical Lift System (VLS), the next evolution in vertical sheet metal storage.

Hospital Bedlifts

Using Vidir’s vertically stacking bed lift systems, you’ll be able to store up to 3x the amount of beds you had previously.

Selective Racks

Selective Pallet Racking is a top choice, it’s ideal for managing diverse SKUs and adapting to frequent stock updates.

Structural Racks

Experience the resilience of Structural Racks, made from sturdy structural steel C-Channels. A fortress of strength...

Drive-in Racks

Maximize your warehouse’s storage density with our Drive-In Pallet Racking system. Tailored for bulk storage of...

Mobile Industrial Racking

Our mobile Industrial Racking solutions such as Spacesaver ActivRAC redefine storage efficiency, integrating innovative technology.

Pallet Flow Racking

Our Pallet Flow Rack system is the epitome of efficiency and customization. From multi-level systems to individual staging lanes...

Cantilever Racks

Our Cantilever Racks are the ultimate storage solution for long and bulky items. With adjustable arms and a range...

Carton Flow Racks

Elevate your order-picking efficiency with our Carton Flow Rack. This system is perfect for streamlining storage and retrieval...

Industrial Automation Solutions

Invest in efficiency with solutions such as ASRS Pallet Shuttles or Vertical Lift Modules. Embrace the future with Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs)...

Modula Vertical Lift Modules

Modula’s Vertical Lift Modules (VLMs) are vertical storage ASRS that take up a minimum footprint by utilizing the ceiling height available. These systems allow for large inventory of goods..

Automated Storage / Retrieval Systems (ASRS)

Automated Storage and Retrieval Systems (ASRS) are sophisticated, computer-controlled systems used to efficiently manage the storage and retrieval...

Order Fulfillment Robots

In the rapidly evolving world of logistics, we’re proud to partner with leaders at the forefront of warehouse automation offering systems designed for warehouse automation and e-commerce fulfillment.

Vertical Carousels & Lifts

Vidir offers vertical inventory management solutions for all industries using Vertical Lift storage to maximize capacity within a minimal footprint, making it a practical option for facilities looking to...

Horizontal Carousels

Modula’s Horizontal Carousel (HC) is the ideal solution when you need high-speed picking in a low ceiling environment. The carousel consists of carriers (bins) mounted on an oval track that rotate horizontally...

Conveyor Systems

We know the right design for a manufacturing, distribution, or warehousing facility can save millions over the course of its operation. Conveyors are one of the technologies that can help...

Wire Cages & Fencing

Elevate your facility’s safety and organization with our comprehensive range of Wire Fence Storage options. From robust Machine Guarding to versatile Pallet Fencing & Tool Crib storage...

Industrial Mezzanines

Transform your workspace with our Free-Standing, Shelving-Supported, and Rack-Supported Mezzanines. Our durable, versatile free-standing mezzanines enhance square footage efficiently...

Modular Offices & Buildings

Elevate your workplace with our Modular Offices, Prefabricated In-plant Buildings, and Exterior Steel Structures. These solutions offer a rapid, cost-effective way to expand your existing facility.

Ergonomic Handling Equipment

Ergonomic handling equipment is designed to reduce the physical strain and risk of injury for workers by fitting the equipment to the user’s needs and the task at hand. This type of equipment minimizes....

Mobile Carts, Drawers & Cabinets

Designed for various industrial settings, these storage solutions offer unparalleled efficiency and accessibility. Modular Drawers & Cabinets are perfect for organizing small parts in heavy-duty environments...

Industrial Safety Equipment

As one of the leading industrial safety equipment suppliers in the country, it is our duty to provide industrial and warehouse workers with the most dependable safety equipment available...

Workbenches & Stations

Modular, ergonomic workstations optimize workspace functionality, enhance task performance, and offer customizable configurations for various job requirements. Experience improved productivity...

Heavy-Duty Bulk Storage

Whether you’re storing boxes, pallets, bulky items, or a combination of items, we can help you find the right mix of mobile and static shelving to optimize your space and streamline processes...

Universal Weapons Rack

In collaboration with Spacesaver, we’ve created a variety of weapons storage systems that create visibility, accessibility,.....

Gun Lockers

Consisting of a welded frame and butt holder with a separate, adjustable rubber-coated barrel rest and base plates, the Weapons......

Weapons Racks II & III

Consisting of a welded frame and butt holder with a separate, adjustable rubber-coated barrel rest and base plates, the Weapons......

Universal Expeditionary

When a unit is deploying or just in training, Spacesaver’s Universal Expeditionary Weapons Storage System (UEWSS) an all-in-one military.....

Pass-Thru Lockers

Pass-thru lockers are built directly into the wall, allowing evidence to be dropped off at one side and retrieved from the other Additionally, these lockers offer......

Non-Pass-Thru Lockers

Non-pass-thru lockers are mounted against the wall, and allow evidence to be deposited and retrieved from the same self-closing...

Short-Term Evidence

All lockers come equipped with Spacesaver’s Keyless Locking System— a no-keys-required unattended evidence deposit deposit; push button,....

High-Density Mobile

If you have a central file storage area that is running out of space or want to consolidate legal file storage space....

Tactical Lockers

When you have individual employees or departments that have smaller file storage needs, file cabinets and drawers..

Static Shelving

If you’re looking for a “no-nonsense” shelf for a central area or to line a wall, 4-post and cantilever shelving are a durable..

Document Scanning

Bradford Digital can either merge or develop a sweeping document management solution in compliance.....

Send Us A Message

Fill out the form below as complete as possible and we will be in touch with you shortly:

Frequently Asked Questions

We offer a variety of storage solutions, including shelving systems, lockers, modular casework, mobile shelving, and automated vertical storage units.

Yes. Our team provides professional space planning services to help you optimize your layout and make the most of your available square footage.

Yes, we offer full-service installation. Our team handles delivery and ensures your system is installed safely, correctly, and ready for use.

Yes. Many of our solutions can be configured to fit your space, workflow, and industry needs. We’ll work with you to create the most efficient setup.

We serve a wide range of industries, including healthcare, education, government, law enforcement, libraries, and commercial businesses.

To get started, you can call us directly on our toll-free number 1-800-696-3453 or fill out our contact form. A member of our team will follow up to discuss your needs and next steps.